How Fortitude Financial Group can Save You Time, Stress, and Money.

How Fortitude Financial Group can Save You Time, Stress, and Money.

Blog Article

Some Known Questions About Fortitude Financial Group.

Table of ContentsNot known Details About Fortitude Financial Group The Facts About Fortitude Financial Group RevealedLittle Known Facts About Fortitude Financial Group.Facts About Fortitude Financial Group RevealedSome Ideas on Fortitude Financial Group You Should Know

Keep in mind that several advisors won't handle your assets unless you satisfy their minimum demands. When picking a financial consultant, locate out if the private complies with the fiduciary or suitability requirement.The wide area of robos covers systems with access to economic experts and investment management. If you're comfortable with an all-digital platform, Wealthfront is another robo-advisor alternative.

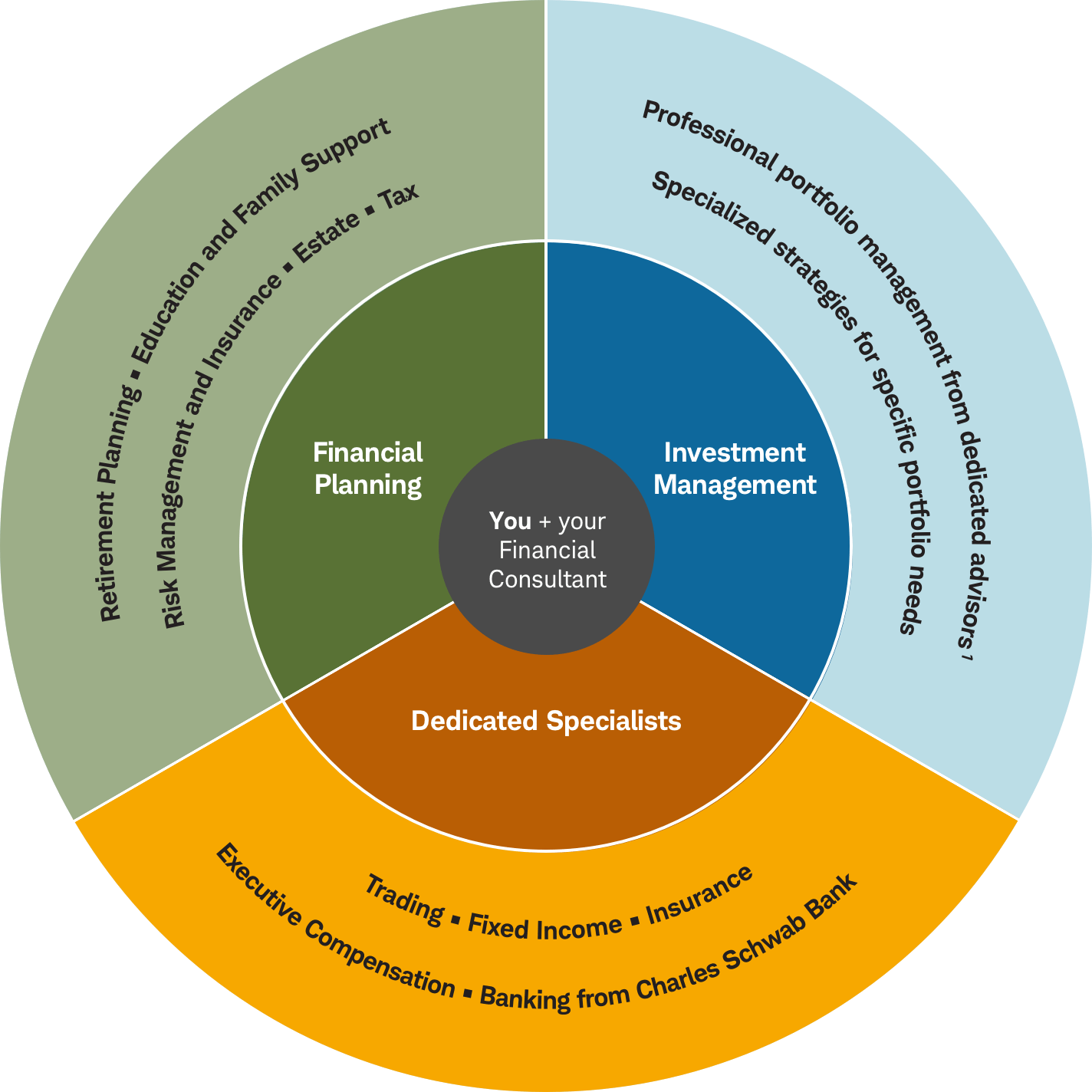

Financial consultants might run their own firm or they could be part of a larger office or financial institution. Regardless, an expert can aid you with whatever from constructing a financial strategy to investing your cash.

Rumored Buzz on Fortitude Financial Group

Make certain you ask the ideal questions of any person you take into consideration employing as a monetary advisor. Examine that their certifications and abilities match the services you desire out of your advisor - https://my-store-fd7e1a.creator-spring.com/. Do you intend to find out more about economic consultants? Take a look at these articles: SmartAsset adheres to a strenuous and in-depth Editorial Plan, that covers principles bordering precision, dependability, editorial freedom, experience and neutrality.

Many people have some emotional connection to their cash or the important things they purchase with it. This psychological link can be a primary reason that we may make inadequate financial decisions. An expert financial expert takes the feeling out of the equation by providing unbiased suggestions based upon knowledge and training.

As you go with life, there are economic choices you will make that may be made a lot more conveniently with the assistance of an expert. Whether you are attempting to reduce your financial debt lots or wish to begin preparing for some lasting objectives, you could gain from the services of a financial advisor.

The Only Guide for Fortitude Financial Group

The fundamentals of investment administration include buying and marketing economic possessions and various other financial investments, but it is much more than that. Managing your financial investments includes understanding your short- and long-lasting objectives and making use of that info to make thoughtful investing decisions. A financial expert can supply the data necessary to aid you expand your investment profile to match your preferred level of risk and fulfill your monetary goals.

Budgeting offers you a guide to just how much money you can invest and just how much you should conserve monthly. Adhering to a budget plan will assist you reach your short- and lasting monetary objectives. A monetary advisor can aid you outline the activity steps to require to establish and keep a spending plan that works for you.

Occasionally a clinical expense or home repair can all of a sudden add to your financial debt tons. A specialist financial obligation administration plan assists you repay that financial debt in the most economically helpful way feasible. A monetary advisor can aid you evaluate your debt, focus on a financial debt repayment technique, offer alternatives for financial obligation restructuring, and describe an all natural plan to far better handle financial debt and meet your future monetary objectives.

The 5-Minute Rule for Fortitude Financial Group

Individual capital analysis can tell you when you can afford to get a new car or just how much cash you can include to your savings monthly without running brief for essential expenses (Financial Resources in St. Petersburg). A financial advisor can assist you clearly see where you invest your money and after that use that insight to assist you comprehend your monetary wellness and exactly how to improve it

Threat monitoring solutions determine potential threats to your home, your lorry, and your family members, and they help you place the ideal insurance coverage in position to minimize those dangers. A financial expert can aid you establish an approach to secure your earning power and lower losses when unforeseen things take place.

The Facts About Fortitude Financial Group Uncovered

Reducing your tax obligations leaves even more cash to contribute to your investments. Financial Resources in St. Petersburg. A monetary expert can assist you use charitable offering and investment approaches to lessen the quantity you must pay in taxes, and they can show you exactly how to withdraw your money in important link retired life in a means that likewise reduces your tax problem

Even if you really did not start early, university preparation can help you place your kid through university without dealing with unexpectedly big expenses. A financial consultant can lead you in comprehending the most effective ways to conserve for future college prices and how to fund potential spaces, discuss just how to decrease out-of-pocket university costs, and suggest you on eligibility for financial help and grants.

Report this page